- Catch The Key Insights

- Posts

- Where should I buy my first home if I work downtown Toronto?

Where should I buy my first home if I work downtown Toronto?

How first-time buyers are choosing space without giving up their downtown jobs.

This is one of the most common questions first-time home buyers ask today, especially current downtown condo tenants who want a freehold home but still need to commute into the city. According to Statistics Canada, more than 55% of Toronto professionals now work in hybrid or flexible arrangements, meaning they commute fewer than four days a week.

That shift has changed the home-buying conversation entirely. What once felt impossible now feels negotiable. The challenge is not whether it can be done, but where it can be done without replacing condo stress with commuter burnout.

Most buyers aren’t trying to optimize everything. They want clarity. They want to know which GTA locations actually work when downtown work is still part of life.

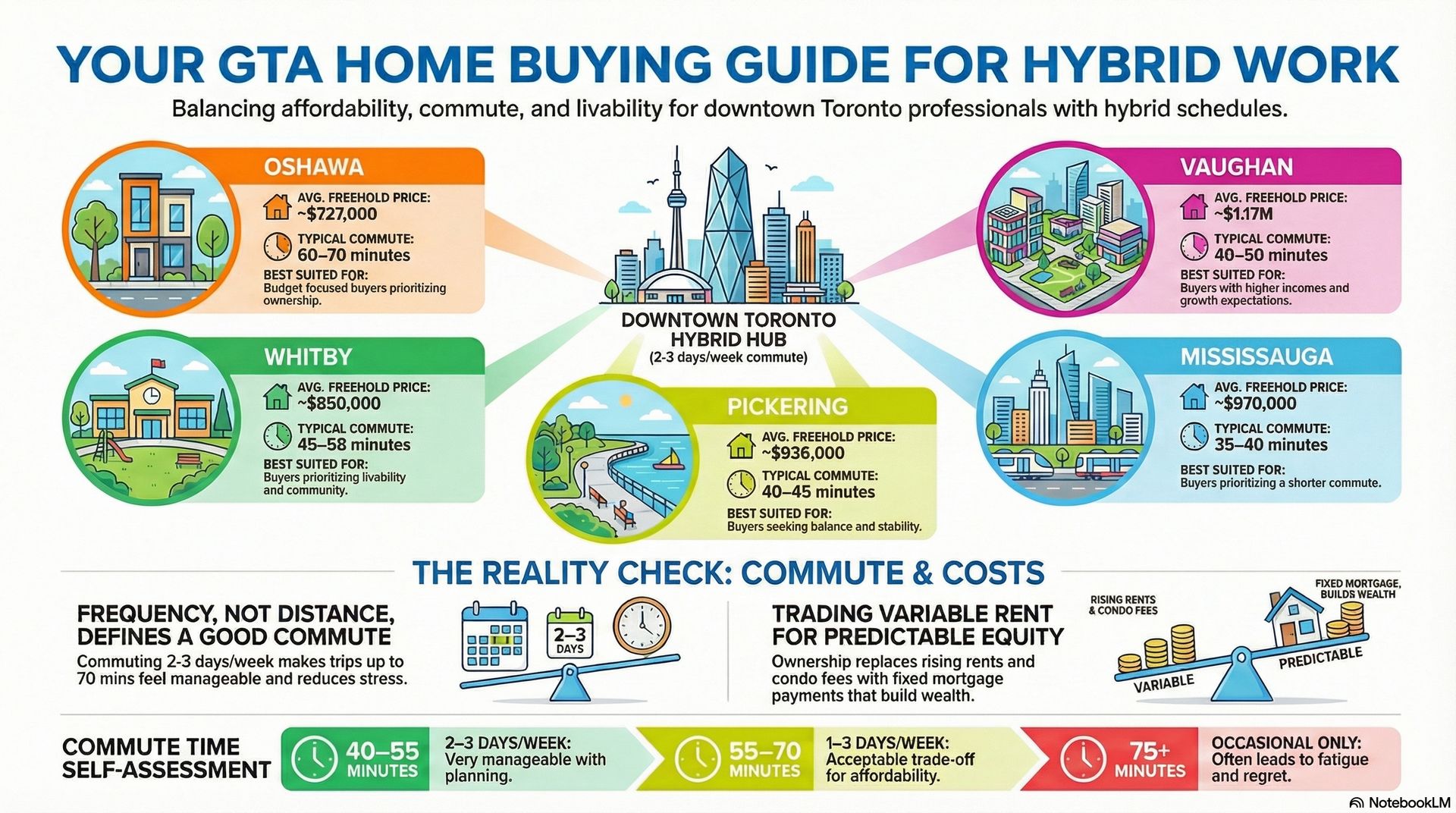

City | Avg Freehold Price (Approx.) | Typical Commute to Downtown | Commute Predictability | Best Suited For |

|---|---|---|---|---|

Oshawa | ~$727,000 | 60–70 minutes | High (GO Train) | Budget-focused buyers prioritizing ownership |

Whitby | ~$850,000 | 45–58 minutes | High (GO Train) | Buyers prioritizing livability and calm |

Pickering | ~$936,000 | 40–45 minutes | Very High (GO Train) | Buyers seeking balance and stability |

Mississauga | ~$970,000 | 35–40 minutes | High (GO + Express Transit) | Buyers prioritizing shorter commute |

Vaughan | ~$1.17M | 40–50 minutes | Moderate–High (TTC + GO) | Buyers with higher income growth expectations |

Is it realistic to commute to downtown Toronto two or three times a week?

Yes, and studies consistently show that commute frequency matters more than commute distance. A Metrolinx commuter experience report found that hybrid workers commuting two to three days per week reported significantly lower stress levels, even when travel times exceeded one hour.

GO Transit performance data shows that typical weekday trips to Union Station from cities like Pickering, Whitby, and Mississauga range between 38 and 58 minutes, depending on time and route.

This explains why many buyers who initially dismiss locations outside Toronto later reconsider them. A commute that feels exhausting five days a week often becomes routine when it happens twice.

Commute Time (One Way) | Works Well If You Commute | Typical Buyer Experience |

|---|---|---|

30–40 minutes | 3–4 days/week | Feels close to downtown routine |

40–55 minutes | 2–3 days/week | Very manageable with planning |

55–70 minutes | 1–3 days/week | Acceptable when offset by space and affordability |

75+ minutes | Occasional only | Often leads to fatigue and regret |

Why are so many downtown condo tenants looking for freehold homes now?

Downtown condo rents have risen sharply. According to the Canada Mortgage and Housing Corporation (CMHC), average condo rents in Toronto increased by over 20% between 2021 and 2024, while unit sizes continued to decline.

At the same time, condo ownership costs have climbed. CMHC reports that average condo maintenance fees across the GTA now range from $0.70 to $0.90 per square foot, and continue rising as buildings age.

Freehold ownership changes that dynamic. Mortgage payments build equity. Costs are more predictable. There is no board deciding how your money is spent. A Royal LePage buyer sentiment survey found that more than 70% of first-time buyers associate freehold ownership with improved mental well-being, mainly due to privacy and long-term stability.

How far is too far to commute to downtown Toronto?

Transportation research from the University of Toronto shows that once one-way commutes exceed approximately 75 minutes, satisfaction drops sharply, even among hybrid workers.

This makes GTA cities within a 40 to 65 minute reliable transit range especially relevant for first-time buyers. The most important factor is not distance, but predictability. Buyers consistently report less stress when commute times are consistent, even if they are longer.

Is Oshawa too far if I work downtown Toronto?

Oshawa is often the most affordable entry point into freehold ownership among GTA cities with direct downtown transit access. According to Toronto Regional Real Estate Board (TRREB) data, the average freehold home price in Oshawa was approximately $727,000 in late 2024, compared to over $1 million in Toronto.

The commute typically ranges from 60 to 70 minutes, but GO Transit ridership data shows sustained growth from Oshawa among hybrid workers since 2021.

Oshawa works best for buyers who prioritize ownership and affordability over proximity, and who are comfortable trading longer travel days for financial breathing room.

Oshawa makes first homeownership feel possible. Real neighbourhoods, real value.

Why do buyers choose Whitby instead of Toronto?

Whitby consistently ranks highly for livability. It has appeared in the top 20 Canadian cities in national rankings focused on safety, green space, and community satisfaction.

TRREB data places average freehold prices in Whitby around $850,000, with commute times typically between 45 and 58 minutes. Buyers often accept the commute in exchange for a calmer, more stable home environment.

Quiet streets, strong communities, and room to grow. Whitby keeps delivering.

Why does Pickering feel like the safest choice for many first-time buyers?

Pickering sits in a balance zone. Average freehold prices are around $936,000, and GO Train commute times typically range from 40 to 45 minutes.

Transit reliability from Pickering is consistently strong, which reduces daily uncertainty. For buyers worried about regret, this balance between price and commute often feels reassuring rather than risky.

Close to the city, closer to the lake, and built for everyday living. Pickering.

Is Mississauga a good alternative to living downtown?

Mississauga offers some of the shortest non-Toronto commute times, averaging 35 to 40 minutes via express transit.

The trade-off is price. Average freehold prices approach $970,000, which typically suits dual-income households more comfortably than single-income buyers, according to CMHC affordability benchmarks.

Location, infrastructure, and upside. Mississauga delivers.

Should first-time buyers consider Vaughan?

Vaughan benefits from TTC subway access and GO connectivity, with commute times usually between 40 and 50 minutes.

However, average freehold prices exceed $1.17 million, placing pressure on first-time buyers. Research from the Bank of Canada shows that early overextension increases household stress, even when incomes are strong.

Not just houses. Neighbourhoods. Vaughan delivers the lifestyle buyers want.

What does the monthly cost actually feel like after leaving a downtown condo?

CMHC reports that many Toronto renters spend over 35% of household income on housing-related costs.

When buyers move into a freehold home, the cost structure changes. Condo fees, paid parking, and storage costs disappear. Mortgage payments feel heavier at first, but Bank of Canada research shows that households with predictable, fixed housing costs report higher long-term financial confidence than renters facing annual increases.

Expense Category | Downtown Condo Tenant | Freehold Home Owner |

|---|---|---|

Housing payment | Rent (variable) | Mortgage (fixed or predictable) |

Condo fees | Included in rent | $0 |

Parking | Often extra | Usually included |

Storage | Often extra | Included |

Equity building | None | Yes |

Cost predictability | Low | High |

Is it harder for single-income buyers to buy outside Toronto?

Single-income buyers generally benefit from prioritizing affordability and resilience. Financial planning research from FP Canada consistently shows that buyers who protect cash flow early experience less long-term stress.

This often means choosing a city with a longer but manageable commute in exchange for lower monthly pressure.

Do dual-income buyers make different location decisions?

Yes. Dual-income households typically have more flexibility, but also face the risk of overextending. The most stable outcomes occur when housing costs remain manageable on one income temporarily, preserving flexibility and reducing pressure.

Buyer Profile | Location Tendencies | Primary Risk | Best Strategy |

|---|---|---|---|

Single-Income Buyer | Oshawa, Whitby | Overextension | Prioritize affordability and predictability |

Dual-Income Buyer | Pickering, Mississauga, Vaughan | Lifestyle pressure | Choose a home manageable on one income |

Final thoughts for downtown condo tenants

The data supports what many buyers already feel. Commuting downtown two or three times a week makes freehold ownership outside Toronto realistic and often life-enhancing. The right decision is not about chasing the shortest commute or the lowest price. It is about choosing a location that supports financial comfort, emotional well-being, and long-term stability.

When chosen thoughtfully, the move out of a downtown condo does not disconnect you from the city. It reconnects you to your life.

Your GTA home buying guide for Downtown Toronto Professionals

Helpful Links & Next Steps

If you’re actively thinking about buying your first home and want to explore your options further, these resources can help you move from research to clarity.

To see what homes are currently available across the GTA, including freehold options suitable for first-time buyers, you can browse our active listings here:

You can also read what local clients are saying on our Google reviews page, which many first-time buyers find helpful during their decision process:

If you’d like to understand who we are, how we work, and how we help first-time buyers navigate these decisions calmly and realistically, you can learn more about Catch The Key here:

If you prefer listening or want to hear real conversations around GTA real estate, commuting, and first-time buying decisions, you can check out our podcast here:

You Can Follow us on our Youtube Channel too -

If you’d like a data-backed snapshot of what’s happening in your area right now, you can request a complimentary market report here:

And if you have specific questions or want to talk through your situation privately, you can send us a message here:

Buying your first home is a big decision - the goal isn’t to rush it, but to make it with clarity.

References

[1] Statistics Canada — Hybrid work trends

https://www150.statcan.gc.ca/n1/daily-quotidien/230131/dq230131b-eng.htm

[2] Metrolinx — GO Transit commuting data

https://www.metrolinx.com/en/projects-and-programs/go-expansion

[3] CMHC — Rental and condominium research

https://www.cmhc-schl.gc.ca/professionals/housing-markets-data-and-research

[4] Bank of Canada — Household financial stability

https://www.bankofcanada.ca/2022/12/household-financial-stability/

Reply