- Catch The Key Insights

- Posts

- Four GTA Housing Trends You Won’t See in the Headlines , But Should.

Four GTA Housing Trends You Won’t See in the Headlines , But Should.

Beyond the scary headlines, the GTA housing market is quietly resetting, not collapsing.

November’s numbers sounded gloomy. But when you look a little closer, the Greater Toronto Area housing market is less “doom scroll” and more “quiet reset.”

November 2025 GTA housing market

Updated: December 2025 Reading time: ~13 minutes Region: GTA & GGH

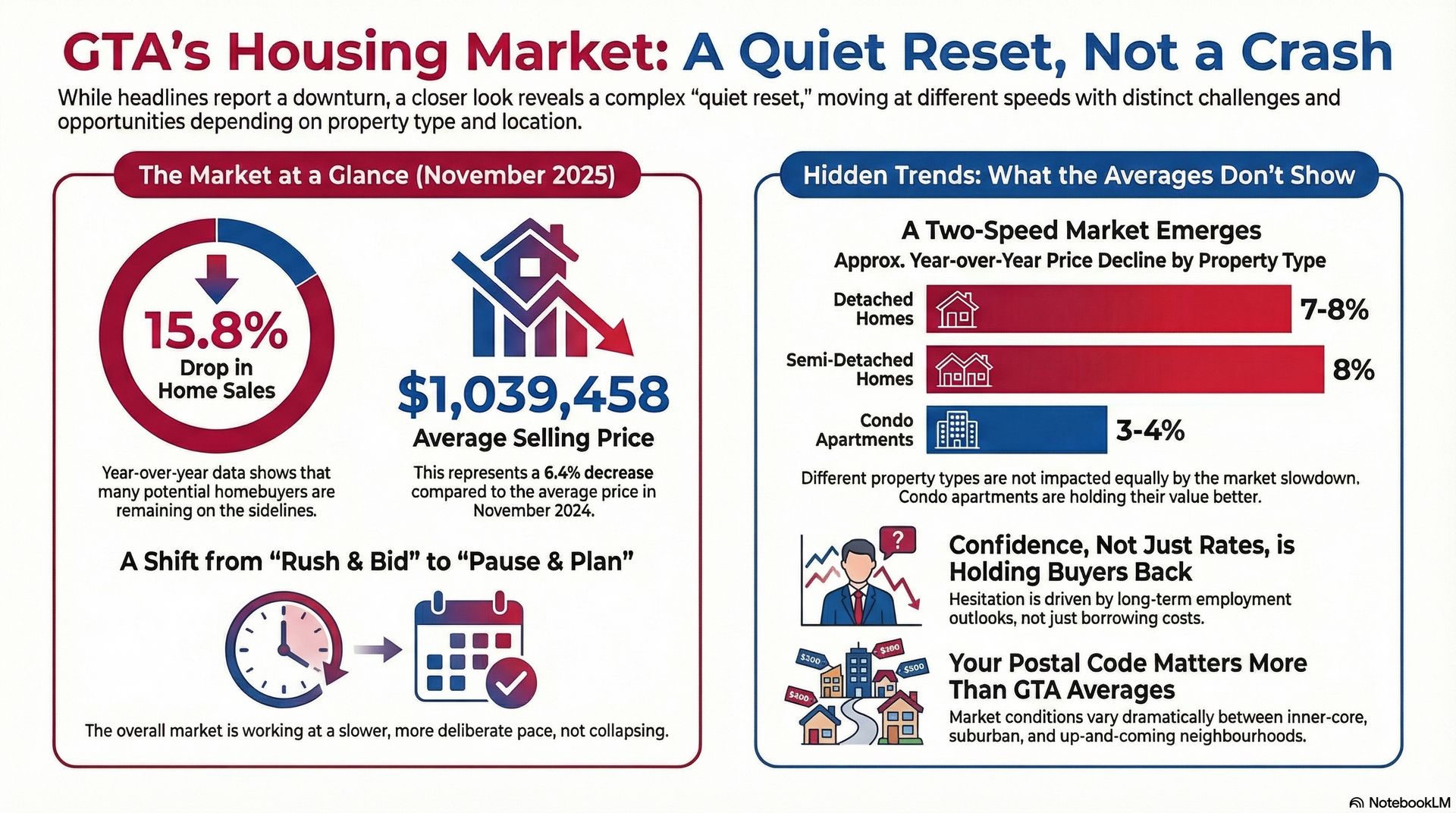

If you live anywhere in the Greater Toronto Area, you have probably seen the headlines: sales are down, prices are down, and the market is “in trouble.” The November 2025 report from the Toronto Regional Real Estate Board (TRREB) does show a softer market on the surface- about 5,010 home sales across the GTA, down 15.8% from last year, with the average price at $1,039,458, down 6.4% year-over-year.

That sounds simple enough. But what we’re seeing on the ground with clients, and inside the data itself, is more layered. The GTA isn’t experiencing one single market. It’s experiencing several, all moving at different speeds.

In this post, we’ll unpack four trends that rarely make it into the clicky headlines but matter a lot if you’re planning to buy, sell, invest - or just stay put and make smart decisions about your home in 2026.

Table of Contents

Short version: The GTA housing market is resettling not collapsing. Prices are down from last year’s levels, and sales are slower, but we still see a steady flow of serious buyers and a very livable market for patient sellers.

Average GTA prices are about 6% lower than a year ago, and benchmark values are down just under 6%, while sales sit roughly 16% below last November. At the same time, Toronto’s unemployment rate is 8.9%, and job growth over the past year has been slower but still positive - not the backdrop of a full-blown crash.

For most of our clients, the real story is this: the market has shifted from “rush and bid” to “pause and plan.” If you know how to work within that shift, you can still move forward confidently.

Where the Numbers Actually Stand Right Now

Let’s anchor the conversation in a quick snapshot of the latest TRREB data for November 2025 before we dive into the quieter trends.

TRREB’s own summary points to what we feel every day in showings: buyers are cautious, sellers are choosier, and the market is working at a slower, more deliberate pace. With the snapshot in place, let’s talk about the four trends you won’t see in most news alerts - but that we think you should keep in mind as you plan your next move.

November 2025 Housing Market infographic

Trend 1: A Two-Speed Market Hiding Behind One Average Price

The headline “GTA prices down 6.4%” makes it sound like every home has quietly stepped down in value by the same amount. In reality, the market is moving at different speeds depending on property type and price point.

One of the most important patterns in the late-2025 data: condo apartments are holding their value better than many ground-oriented homes. That might feel surprising if you remember the early pandemic days when detached homes far outside the core were the stars of the show.

Condos vs. Houses: Not the Same Story

Across the GTA, year-over-year price changes look something like this at a high level:

Detached homes: roughly 7–8% price declines

Semi-detached homes: around 8% declines

Townhouses: mid-range declines of about 5–6%

Condo apartments: smaller drops, closer to 3–4%

Exact numbers vary by sub-market, but the pattern is consistent: condos are cushioned. They have not been immune to the slowdown, but their lower price point and continued investor and first-time-buyer interest help soften the blow.

Buyers looking for a first step into the GTA market are quietly shifting their expectations- choosing a well-located condo today instead of stretching for a detached home tomorrow.

Why Condos Have a Cushion Right Now

In a higher-rate environment, affordability rules everything. A downtown or transit-friendly condo at $650,000–$800,000 simply lines up better with many pre-approved budgets than a $1.3M–$1.6M detached home, even if that detached home has come down from its peak.

We see three big drivers behind the “condo cushion”:

Payment-based decisions. Buyers are shopping based on monthly cost, not just sticker price. Condos usually win that comparison.

Investor math still works in some pockets. With the right rents, a modest price correction can actually improve long-term returns.

Younger buyers are re-prioritizing location. Many are choosing walkability, transit, and amenities over extra square footage.

We also see a split within the condo segment itself: the most resilient units tend to be:

In buildings with strong management and realistic maintenance fees

Close to rapid transit or job centres

Offering practical layouts rather than only “Instagram” finishes

What This Means for You

First-Time buyers. Move-up sellers. Investors

If you’re a first-time buyer, this is the first time in years that we can sit down, breathe, and calmly match your pre-approval with a realistic list of homes. You might be surprised how far your budget now goes in certain condo and stacked-townhome pockets across Toronto, Mississauga, and Hamilton.

If you’re a current homeowner thinking of moving up, the math can actually work in your favour: even if your condo has slipped a few percent, the detached home you’re eyeing has likely slipped more in dollar terms. The gap you need to “bridge” may be narrower than you think.

And if you’re an investor, 2025–2026 looks less like a “get rich by spring” story and more like a chance to quietly acquire the right property in a calmer market. Our current listings include a rotating set of these “boring but brilliant” homes.

Trend 2: Confidence, Not Just Rates, Is Holding Things Back

Interest rates have lowered from their peak, and buyers are finally seeing more stable monthly payment scenarios from their mortgage brokers. Yet many households are still on the sidelines. Why?

The short answer: confidence.

Jobs, Headlines, and Group Chats

On paper, the story is mixed. Toronto’s unemployment rate sits around 8.9% as of September 2025, higher than we’ve been used to and among the higher rates across major Canadian cities. At the same time, the City of Toronto’s own employment survey shows overall job counts still rising modestly - up about 1.5% year-over-year, with growth concentrated in full-time roles. For many people, those two facts collide with the daily reality of:

Corporate restructuring announcements in the news

Friends talking about contract work instead of full-time roles

Social media posts about “waiting to see what happens” before buying

TRREB’s November commentary captures this tension clearly: many GTA households would like to take advantage of lower borrowing costs and softer prices, but they need more confidence in their long-term employment outlook before they act. Buyers aren’t saying, “We’ll never buy.” They’re saying, “We want one or two more signs that the ground under our feet is solid - then we’ll move.”

Catch The Key team perspective from day-to-day client conversations

How Confidence Shows Up in Real Conversations

In our buyer strategy calls, the most common questions sound like this:

“What happens if rates go down again - will I regret buying now?”

“My company just went through layoffs. Should I pause even though my job is safe?”

“Is this the bottom, or is there another shoe to drop?”

None of these questions are about the beauty of a kitchen or the size of a backyard. They’re about predictability. Until that feeling returns, some buyers will stay in “research mode” instead of “offer mode.”

Turning Uncertainty into a Plan

Here’s the good news: you don’t need perfect confidence to move. You need a plan that respects uncertainty. That can look like:

Buying slightly under your maximum approval to create cushion

Choosing a location with strong rental backup options, in case life changes

Negotiating flexible closing timelines to match possible job or life milestones

If you’d like help building that kind of plan, our team puts a lot of emphasis on scenario planning — not just “finding a listing.” You can send us a message with a short note about your situation, and we’ll map out practical next steps.

Trend 3: Your Postal Code Matters More Than the GTA Average

One thing the GTA does better than almost anywhere else: hide completely different markets within a 20-minute drive.

When TRREB publishes an “average GTA price,” it’s blending together:

A downtown one-bedroom near Union Station

A three-storey semi in Roncesvalles

A 1980s detached in Mississauga

A newer family home in Milton or Bradford

A townhouse in Hamilton or Cambridge

On the ground, we’re seeing three broad patterns across neighbourhoods:

1. Inner-Core Resilience

Neighbourhoods close to strong transit and job nodes — think central Toronto condo hubs, pockets along Line 1 and Line 2, and parts of Mississauga’s city centre — are seeing:

Fewer dramatic price cuts

More “quiet” multiple offers on the best listings

Buyers who are willing to accept smaller spaces in return for lifestyle and commute perks

2. Suburban Rebalancing

Areas that saw the sharpest price run-ups during the remote-work boom (some 905 communities and exurbs) are now giving back a slice of those gains. In practical terms, that means:

Detached homes that once attracted 10–12 offers now getting 1–3

More room for conditional offers on inspection and financing

Buyers able to negotiate on homes that sat just out of reach in 2021–2022

3. Up-and-Coming “Middle” Pockets

Then there are the neighbourhoods in between — the ones where a client will say, “My friend bought here three years ago when no one was talking about it.” These pockets often have:

Walkable main streets that are improving year by year

Early transit upgrades or new GO service

Family-friendly townhome and low-rise options

We find some of the best “value per lifestyle point” in these areas - where you aren’t paying peak prices, but you also aren’t sacrificing on community.

Averages are helpful for headlines. But if you’re making a six- or seven-figure decision, you need neighbourhood-level data, not just GTA-wide charts.

How to Read Past the Averages

Here are a few ways to zoom in on what really matters for your postal code:

Look at trend lines, not single points. We track how a neighbourhood’s months of inventory, average days on market, and sale-to-list price ratio have moved over the last 6–12 months, not just in November.

Compare similar homes only. A renovated three-bedroom freehold and a dated two-bedroom condo will never move in sync. We break the data down by style, size, and condition.

Blend stats with “shoe-leather” insights. Sometimes the best information comes from how many buyers show up to a Saturday open house in the rain.

If you’d like this level of detail, our complimentary market report pulls together recent sales, trends, and insights tailored to your neighbourhood (or the one you’re considering).

You can also keep an eye on trends in our main Catch The Key blog and on our external newsletter, where we regularly break down specific cities like Cambridge, London, and Mississauga in plain language.

Trend 4: The “Missing Middle” Will Shape the Next 5 Years

The November TRREB report also hints at a longer-term issue that doesn’t show up fully in this month’s numbers: future supply - especially in the types of homes many families actually want.

Right now, the resale market feels well-supplied. Buyers have options. But as those listings are absorbed, the question becomes: what replaces them?

What Is the “Missing Middle”?

In housing policy circles, the “missing middle” refers to gentle-density homes that sit between high-rise condo towers and traditional detached homes. Think:

Townhouses and stacked townhomes

Duplexes and triplexes

Low-rise walk-up apartments

Laneway and garden suites

For many GTA households, these types of homes hit the sweet spot between space, price, and location. But they’re still underbuilt in many established neighbourhoods.

Why This Matters Even in a “Downturn”

It might feel strange to worry about future supply when you can scroll through pages of listings today. But real estate markets move in cycles:

Today’s slower pre-construction launch is tomorrow’s missing inventory.

Today’s cautious builder is tomorrow’s shortage in a specific home type.

Today’s zoning debate is tomorrow’s opportunity - or constraint - on gentle density.

TRREB has been clear: as current inventory gets absorbed, new construction - especially in these “middle” formats will be critical for long-term affordability and choice.

How We See This Playing Out in the GTA

In the coming years, we expect:

More intensification on existing lots. Think laneway suites in Toronto’s west end, garden suites in Scarborough, and multi-unit conversions of larger detached homes.

Townhome rows along transit corridors. Especially near new LRT and GO expansions where land assembly makes sense.

A premium on family-sized units in mid-rise buildings.Not just one-bed condos, but two- and three-bedroom layouts that let families stay urban.

For homeowners, this can open up creative options - from adding a secondary suite to reconfiguring a property for multi-generational living. For buyers, it means expanding your search beyond “condo vs. detached” into a broader menu of housing types.

So… What Does All of This Actually Mean for You?

Let’s move from theory to action. Here’s how these four under-the-radar trends play out depending on where you are in your real estate journey.

If You’re a First-Time Buyer

Use this “reset” window to your advantage — you have more time to think and fewer bidding wars to crash into.

Consider starting with a condo or stacked townhome in a strong location instead of waiting for a detached home to drop into your budget.

Get a clear sense of value with a market report and a tour of recently sold properties, not just active listings.

If you want a structured game plan, our article “10 Smart Things to Do Now If You Want to Buy a Home in Toronto (or the GTA) by 2026” on the Catch The Key Insights newsletter walks through step-by-step prep - from credit to neighbourhood scouting.

If You’re Thinking of Selling

The market is more price-sensitive than it’s been in years. Strategy, preparation, and timing matter more than ever.

Focus on positioning: the right renovations, staging, and pricing can still create strong interest, even in a slower market.

Look at the full “sell and buy” equation. In many cases, you’ll sell for a bit less but also buy for less - and the upgrade gap shrinks.

If you’re curious where your home stands in today’s market, you can start with our online tools: Find out what your home is worth or click here for a free home evaluation.

If You’re an Investor

For investors, this is the moment to zoom out from month-to-month volatility and think about the next decade:

Population growth in the GTA and GGH remains strong.

Housing starts have not kept up with long-term demand.

The rental market in many pockets remains tight, with solid long-term fundamentals.

We’re spending a lot of time helping clients re-underwrite their existing properties and model potential purchases using more conservative numbers. If you like that kind of nerdy deep dive, you’ll probably enjoy our Catch The Key podcast, where we unpack real deals and real numbers.

Why Working With the Right Team Matters in a “Messy Middle” Market

This part of the cycle can feel confusing: not hot, not cold, just… complicated. That’s where having advisors who live and breathe the GTA market helps. At Catch The Key Inc., we:

Operate under RE/MAX West Realty Inc., combining local street-level insight with a large brokerage network.

Track not just the TRREB headlines, but micro-trends in cities from Toronto and Mississauga to Cambridge and London.

Back everything with real client outcomes - you can read some on our testimonials page and see more on our 5-star Google reviews

You can also read what local clients are saying on our Google reviews page.

GTA Housing FAQ: Short, Straight Answers

Is the GTA housing market crashing?

No. Prices and sales are down year-over-year, but this looks much more like a reset than a collapse. The biggest change is in how people feel — more cautious, more thoughtful, less rushed.

Should I wait for prices to drop further?

It depends on your life, not just the chart. If your job, family, and finances are ready, waiting for a “perfect” bottom can backfire. Instead of trying to time the market, we suggest focusing on buying a home that works for you and that you can comfortably hold through ups and downs.

Are there still bidding wars?

Yes, but they’re more selective. Truly standout homes in highly desirable pockets — especially those updated, staged, and priced correctly - can still attract multiple offers. Average homes at wishful prices? Not so much.

How do I know what my specific home is worth?

Automated estimates are a good starting point, but they can’t see your upgrades, layout, or street. For a clearer picture, you can request a complimentary home valuation or ask us for a detailed pricing strategy session.

Where can I learn more about Catch The Key?

You can learn more about us here, browse our client testimonials, and explore other articles on our main blog page.

Want a Clear Plan for Your Next Move?

Whether you’re buying your first condo, trading up to a family home, or planning your next investment, we’ll walk you through the numbers, the neighbourhoods, and the timing - in plain language.

Max, our Chief Entertainment Officer (and very good dog), is also happy to supervise strategy sessions in the office.

Prefer to listen on the go? Follow our podcast on Spotify

If you’re a REALTOR® and thinking about a change, you can also explore joining our team here.

Sushil Mishra is a REALTOR® with RE/MAX West Realty Inc. and co-leads the Catch The Key Inc. real estate team alongside Himani Sood. Drawing on deep experience in the GTA and Greater Golden Horseshoe, Sushil helps clients move from “overwhelmed” to “in control” with data-backed strategies, calm guidance, and the occasional coffee-fuelled street tour.

Curious how Catch The Key works with clients? You can read more testimonials here or explore who we are as a team.

Sources and further reading:

Toronto Regional Real Estate Board (TRREB), November 2025 Market Watch and releases - summary of sales, price, and listing trends for the GTA. (trreb.ca)

Statistics Canada · Labour Force Survey, September 2025 - Toronto CMA labour market update, unemployment at 8.9%. (statcan.gc.ca)

City of Toronto · 2025 Employment Survey Bulletin — city-wide job counts and growth trends.

Ontario Government · Labour Market Report, September 2025 - regional unemployment trends across Ontario.

This article is for general information only and is not financial or legal advice. For guidance about your specific situation, please consult with appropriate professionals.

Reply